Solana has quickly grown to become one of the most popular layer-one blockchains.

While various decentralized finance (DeFi) applications have been available on Solana for years, the network became a cornerstone of the market in 2024 with the emergence of the memecoin craze.

All of this new activity has created increased interest in terms of Solana taxes.

While most local tax authorities haven't provided specific guidance for Solana itself, rulings about cryptocurrency and DeFi in general can be applied to determine your tax liabilities.

For instance, the Internal Revenue Service (IRS) in the U.S. and various tax agencies in other jurisdictions have provided plenty of guidance related to crypto taxes, as well as specific guidance for DeFi in some cases.

This Solana tax guide will help you understand the taxes that you may owe as a result of using various Solana DeFi applications.

For information related to a specific tax jurisdiction, make sure to check out our country-specific crypto tax guides.

{{solana-calloutbox-1}}

{{calculate-your-solana-tax}}

How is Solana taxed?

Solana can be used to build a wide variety of DeFi applications.

Any crypto use case, from stablecoins to non-fungible tokens (NFTs), can be found on Solana, which means there’s a large range of taxable events you may have engaged in.

Some of the most common taxable activities on Solana include:

- Memecoin and NFT trading

- Trading on decentralized exchanges (DEXs)

- Borrowing and lending

- Staking

- Bridging

The diversity in DeFi applications found on Solana means there could be a several different types of taxes that need to be considered, perhaps even in a single transaction.

To help you manage this, consider using software such as Crypto Tax Calculator to make sure you’re keeping track and paying the necessary taxes.

Taxable events on Solana

How Memecoins and NFTs on Solana are taxed

Memecoins were the first major use case for Solana that had not previously been found on other platforms, at least at the scale found on Solana. While memecoins on their own, separate crypto networks, such as Dogecoin, had previously existed, the introduction of Pump.fun on Solana allowed anyone to easily create their own memecoin in an easy and simple manner.

Whether you’re a creator of memecoins or just someone who trades them, there are a few different areas of potential Solana taxation that should be watched. Additionally, the way in which a memecoin is generated can alter the tax obligations for the creator of the coin.

If you have created a memecoin, you are likely taxed as the owner of that asset. That means that you pay income tax on the full proceeds of the coin when it is sold. In other words, your cost basis is $0 for the asset.

If you purchased your own coin on Pump.fun, you will establish a cost basis for the asset equal to the FMV minus any applicable fees. This is different than the above scenario because you are purchasing the asset and not creating it.

How Solana DEX trading

Whether it be memecoins, stablecoins, or other Solana-based assets, there is plenty of DEX activity that takes place on this layer-one blockchain. And the tax obligations of DEX trading activity is similar to how things work on traditional, centralized exchanges.

In terms of Solana taxes related to DEX trading, the main thing you will need to think about is the profit made any time you sell an asset. These gains are subject to capital gains taxes in most jurisdictions.

Notably, you could be subject to a taxable event any time you trade between two different crypto assets on a Solana-based DEX, even if those assets are intended to be equal to each other in value (such as two US-dollar stablecoins). For this reason, it’s essential to remain as thorough as possible when it comes to tracking your Solana transactions. is taxed

How borrowing and lending on Solana is taxed

Borrowing and lending crypto assets and stablecoins has become one of the most prominent use cases of this technology over the years, and the low fees associated with Solana make it the perfect base layer for this sort of activity. In most cases, DeFi users are looking to borrow stablecoins against their crypto asset holdings as a way to access that liquidity without having to sell the underlying assets.

It should be noted that borrowing against your crypto holdings is not a risk-free endeavor, as liquidation events can occur in a situation where crypto prices see a sharp downturn in a short period of time. These liquidation events also have their own tax implications, as the liquidation of crypto collateral is effectively a sale of those crypto holdings where capital gains must be tracked.

To be clear, borrowing stablecoins against crypto assets will generally not involve a taxable event, as long as a liquidation event does not occur. That said, liquidation events can introduce additional complexity where the assistance of a tax professional or crypto tax software like Crypto Tax Calculator can be immensely helpful.

In terms of the lending side of the equation, anyone who is lending stablecoins, for example, to another party in a DeFi application will need to track their earned interest. Interest earned from lending crypto assets to others will generally be taxed as income in most jurisdictions.

{{solana-taxes-made-easy}}

How Solana Staking is Taxed

Solana is a proof-of-stake network, which means holders of the network’s underlying crypto asset, SOL, are able to leverage their holdings to participate in the consensus process. In exchange for participating in consensus, SOL stakers are able to earn rewards based on newly-issued SOL and the transactions taking place on the network at any one time. Check out our full staking guide for more information on how this DeFi activity works.

In most tax jurisdictions around the world, staking rewards tend to be treated as taxable income, similar to the earned interest covered in the previous section. That said, there may be other Solana tax considerations to be made if you’re converting your SOL rewards to cash or other crypto assets rather than simply holding the SOL or adding it to your staking stack. In a situation where the SOL rewards have increased in value before they are sold for another asset, capital gains taxes will likely come into play.

How bridging to and from Solana is taxed

Bridging is the process by which an asset can be effectively transferred from one blockchain network to another. From a technical perspective, the bridging process usually works by freezing a crypto asset in a smart contract on the source crypto network and issuing a new, derivative token on the new network.

Bridging taxation is oftentimes an overlooked part of DeFi activity because some users do not view it as swapping one asset for another. While it may be seen as being overly compliant to some DeFi users, the reality is that bridging an asset from one network to another could be construed as a taxable event in some jurisdictions because it is still swapping one asset for another—even though those assets are intended to be equal to each other.

This is the sort of Solana tax question where there is still a lack of absolute clarity in many jurisdictions, so you’ll want to consult with a tax professional in your local area to gain better guidance. When it comes to a new, emerging asset class like crypto, it is usually best to err on the side of caution when it comes to potential tax ambiguity.

What is the best tax software for Solana?

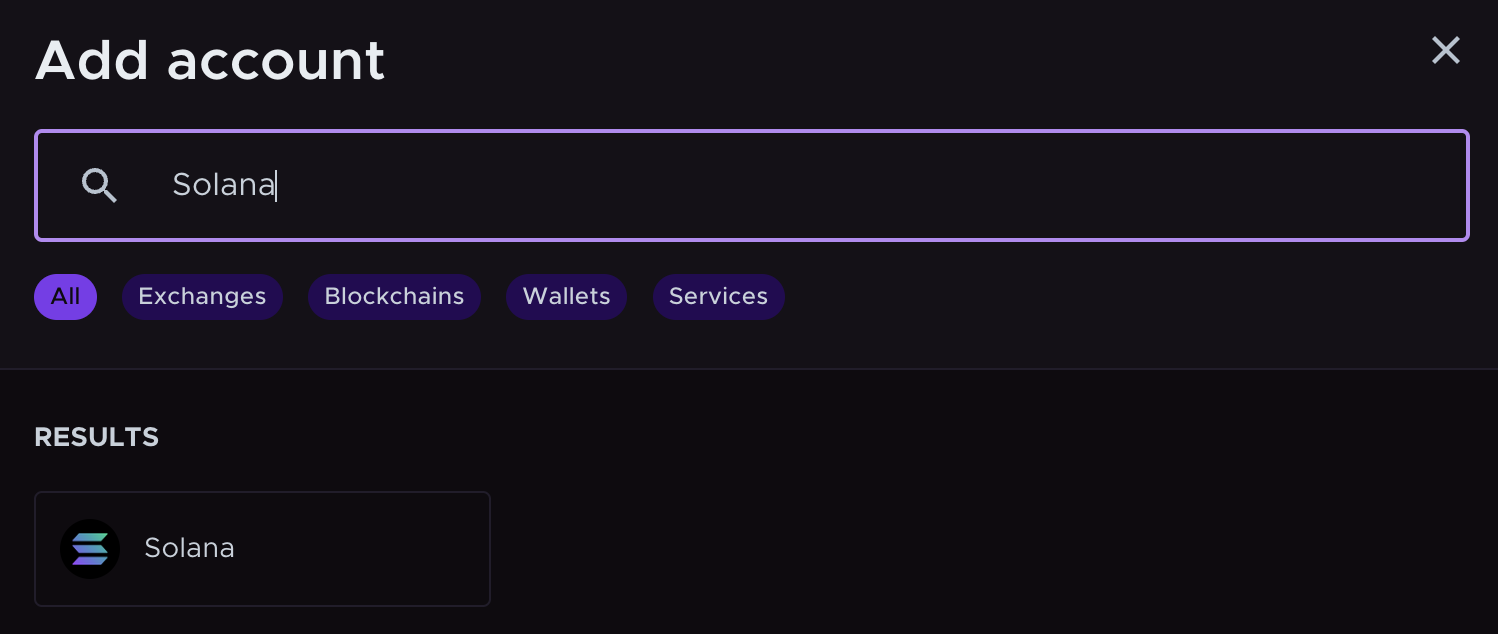

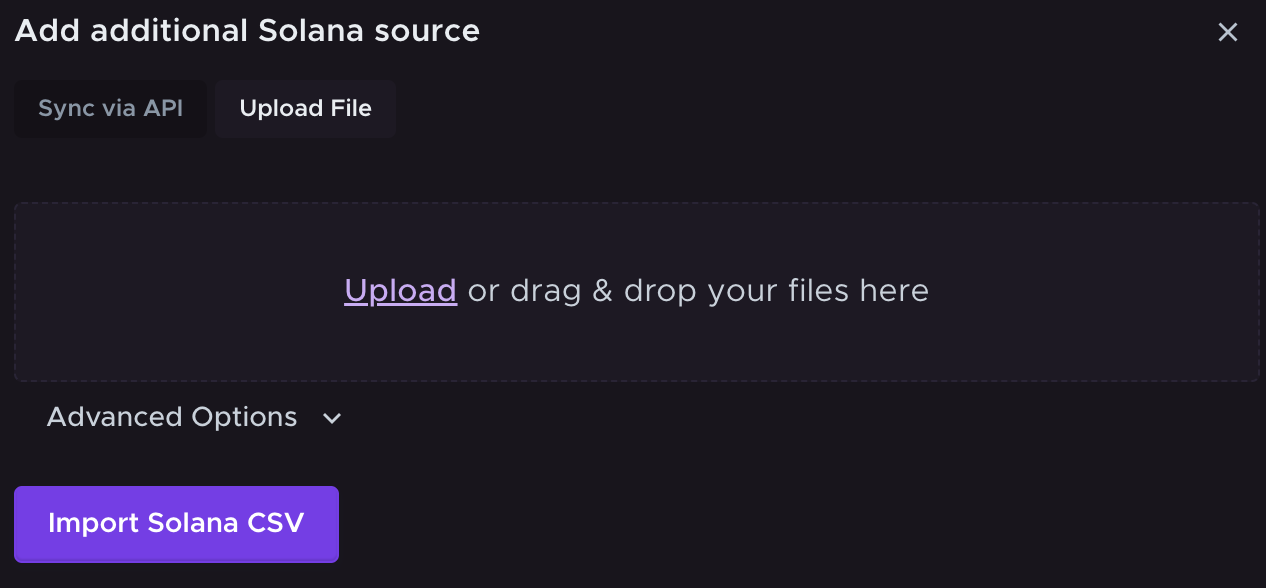

We may be slightly biased, but we think Crypto Tax Calculator is the best tax software for Solana.

Crypto Tax Calculator analyses all of your Solana transactions to calculate capital gains, income and expenses. You can add as many accounts as you like from other supported blockchains, exchanges, and wallets, streamlining the tax process and saving you a headache.

There’s no need to worry about meeting the reporting standards of your local tax authority either. Crypto Tax Calculator generates tax reports that comply with the requirements of numerous tax authorities, including the IRS, HMRC, ATO, CRA, and many more.

With a single account, you have all your transaction data in one place, and the heavy lifting will be done for you for years to come.

But don’t just take our word for it. Crypto Tax Calculator has a 4.8-star rating on Trustpilot, with countless positive reviews. It is trusted by accountants worldwide and is the official tax partner of Coinbase and MetaMask, two of largest crypto platforms in the world.

{{get-your-solana-tax-report-today}}

{{solana-calloutbox-2}}

Ready to make crypto taxes simple?

If you haven’t already, sign up for Crypto Tax Calculator to get your Solana tax report in minutes.

With a single account, you have all your transaction data in one place, and the heavy lifting will be done for you for years to come.

Make sure to review your report and then confidently file your taxes knowing you’ve covered your crypto activity. Keeping accurate records and reporting your crypto gains/income is crucial for staying compliant with tax laws.

If you have any issues or questions, our support team is here to help (reach out via chat or email). Crypto taxes are much easier when you have the right tools – and we’re happy to provide that for you.

{{solana-taxes-made-easy}}

Les informations fournies sur ce site Web sont de nature générale et ne constituent pas des conseils fiscaux, comptables ou juridiques. Il a été préparé sans tenir compte de vos objectifs, de votre situation financière ou de vos besoins. Avant d'agir sur la base de ces informations, vous devez évaluer leur pertinence par rapport à vos propres objectifs, votre situation financière et vos besoins et demander conseil à un professionnel. Cryptotaxcalculator décline toutes garanties, engagements et garanties, expresses ou implicites, et n'est pas responsable de toute perte ou dommage de quelque nature que ce soit (y compris une erreur humaine ou informatique, négligente ou autre, ou une perte ou un dommage accidentel ou consécutif) découlant de, ou dans connexion avec, toute utilisation ou confiance dans les informations ou les conseils contenus dans ce site Web. L'utilisateur doit accepter l'entière responsabilité associée à l'utilisation du matériel de ce site, quel que soit le but pour lequel cette utilisation ou ces résultats sont appliqués. Les informations contenues sur ce site Web ne remplacent pas les conseils d'un spécialiste.