If you’ve been using %blockchainName%, it’s important to understand how to report your crypto taxes. Like most blockchains, %blockchainName% does not automatically report, calculate, or issue tax forms for you. It’s up to users to report their gains, losses, and income based on their activity. This must include all blockchains and exchanges you’ve transacted on, not just %blockchainName%. The good news is that Summ makes calculating your %blockchainName% and crypto taxes quick and easy by automatically importing your data and generating comprehensive tax reports.

Disclaimer: The information in this guide is general in nature and not written for a specific tax jurisdiction or audience.

Do I need to pay taxes on %blockchainName%?

If you have been transacting on %blockchainName% during the tax year, or sold any %blockchainCode%, then it’s likely you will need to pay tax based on your trading activity.

Typically, anytime you sell crypto for fiat, trade crypto-to-crypto, or earn crypto income (e.g., through staking or rewards on %blockchainName%), it is considered a taxable event in most countries.

The exact tax you owe (capital gains or income tax) will depend on your local regulations and the specifics of each transaction. Check our list of local crypto tax guides for details on how cryptocurrency is taxed in your jurisdiction.

Do I have to pay tax if I only bought %blockchainCode% but didn’t sell?

In most parts of the world, you do not pay any tax when you purchase crypto.

It is only when you later dispose of that crypto – i.e., sell it or trade it for another asset – that a taxable event occurs and you need to report it on your tax.

What %blockchainName% transactions are taxable?

The following are common transactions on blockchains like %blockchainName% which are relevant to tax:

Most countries typically tax proceeds earned from selling investments differently from money earned as income. In crypto, you may be subject to both capital gains and income tax, depending on the nature of your transaction:

Capital Gains tax events from %blockchainName%

Whenever you sell %blockchainCode% or make a crypto-to-crypto swap using the %blockchainName% blockchain, you are disposing of an asset.

If the value of the crypto at the time of sale/trade is higher than when you acquired it, you have a taxable capital gain.

If it’s lower, you have a capital loss (which can often be used to offset other gains).

Summ will automatically calculate these gains and losses for each trade using your imported transaction data. It will also account for fees according to your local tax rules.

Income tax from %blockchainName%

If you received crypto as a reward on %blockchainName% for activities such as staking, lending, or yield farming – those tokens are usually considered income.

The value of the crypto at the time and date you received needs to be reported as income. It also forms the cost basis if you later sell the asset.

Summ will automatically categorise income tax events and treat them according to your local tax rules.

How to calculate %blockchainName% taxes with Summ

1. Import your data

First, you will need to import your %blockchainName% transaction data to Summ. Here’s how:

Sync via API

This method uses a secure API feed to transfer your transaction data from the %blockchainName% to Summ. Using an API ensures that your data will be updated over time, so that any change in your %blockchainName% balance is reflected in Summ.

- Sign in to Summ or create an account. Navigate to the Accounts tab and click + Add accounts.

- Select %blockchainName% from the list of integrations. Click on Sync via API.

- Enter your Ethereum wallet address. Add an optional nickname, and click 'Add Wallet'.

- Summ automatically imports your %blockchainName% transaction history from the blockchain. This may take a few seconds to a few minutes depending on the number of transactions. You’ll see a confirmation when all data is imported.

Generate your tax report

Once your %blockchainName% data is imported to Summ, you can calculate your taxes with a few clicks.

- Import accounts.

Add any other exchange accounts, wallets or transaction data to Summ. You will need to upload your entire crypto transaction history for an accurate report. This includes all wallets, blockchains and exchange accounts. - Review transactions

While Summ does the hard work for you, it may flag some missing data or errors, which you will need to review to ensure accuracy. - Get your tax report

Generate a comprehensive tax report ready for your accountant or local tax authority.

If you're new to Summ, try our Getting Started Guide for an overview of how the platform works. If you need assistance at any stage, click the chat icon in the bottom right corner to begin a live chat with our expert customer service team.

How to file your %blockchainName% tax report

Here’s what to do with your exciting and new crypto tax report:

- Review your tax report. After importing, you can generate a tax report for %blockchainName% and any other accounts you linked. This report will detail your net capital gains, losses, and income from crypto for your chosen financial year. Review it to make sure everything looks correct. If something looks off, return to the Review tab to ensure all transactions are categorized correctly; check the Accounts tab to ensure all your accounts and their transactions have been added.

- Download and complete the necessary tax forms. Summ can produce specific forms or summaries needed for filing. For example, if you live in the US, it can produce a report ready to upload to TurboTax. There are also specific forms like Form 8949 and Schedule D that contain the relevant information for crypto. Summ’s reports are designed to be tax-office compliant, making this straightforward.

- File before the deadline. Make sure you file your taxes before the deadline in your country. Properly reporting your %blockchainName% crypto activity will keep you compliant and help you avoid any penalties.

If you’ve been using %exchangeName%, it’s important to understand how to report your crypto taxes. Like most exchanges, %exchangeName% does not automatically report, calculate, or issue tax forms for you. It’s up to users to report their gains, losses, and income from the platform.

The good news is that Summ makes calculating your %exchangeName% taxes quick and easy by automatically importing your data and generating comprehensive tax reports.

Disclaimer: The information in this guide is general in nature and not written for a specific tax jurisdiction or audience.

Do I need to pay taxes on %exchangeName%?

Yes, you will likely need to pay tax if you used %exchangeName% during the tax year.

You will owe capital gains tax or income tax, depending on the nature of your transactions, and whether or not you receive any token rewards from %exchangeName%.

The exact tax you owe will depend on your local regulations and the specifics of each transaction. See our list of local crypto tax guides for details on how cryptocurrency is taxed in your jurisdiction.

How are %exchangeName% transactions taxed?

The taxation of DeFi platforms like %exchangeName% can vary depending on your tax jurisdiction.

Most countries typically tax proceeds earned from selling investments differently from money earned as income. You may be subject to both capital gains (CGT) and income tax, depending on the nature of your transaction.

Here’s how transactions on DeFi platforms like %exchangeName% might be treated:

%exchangeName% capital gains tax (CGT) events

%exchangeName% income tax events

%exchangeName% that are not taxed

Does %exchangeName% report to the IRS?

%exchangeName% is not required to report user activity to the IRS, however, that does not mean your transactions can’t be traced.

Blockchains are public ledgers, which makes it easy to track a wallet's activity. The IRS uses sophisticated data collection and analysis to match your real-world identity with your on-chain activity.

How to calculate %exchangeName% taxes with Summ

1. Import your data

First, you will need to import your %blockchainName% transaction data to Summ. Here’s how:

Sync via API

This method uses a secure API feed to transfer your transaction data from the %blockchainName% to Summ. Using an API ensures that your data will be updated over time.

- Sign in to Summ or create an account. Navigate to the Accounts tab and click + Add accounts.

- Select %blockchainName% from the list of integrations. Click on Sync via API.

- Enter your Ethereum wallet address. Add an optional nickname, and click 'Add Wallet'.

- Summ automatically imports your %blockchainName% transaction history from the blockchain. This may take a few seconds to a few minutes depending on the number of transactions. You’ll see a confirmation when all data is imported.

2. Generate your tax report

Once your %blockchainName% data is imported to Summ, you can calculate your taxes with a few clicks.

- Import accounts.

Add any other exchange accounts, wallets or transaction data to Summ. You will need to upload your entire crypto transaction history for an accurate report. This includes all wallets, blockchains and exchange accounts. - Review transactions

While Summ does the hard work for you, it may flag some missing data or errors, which you will need to review to ensure accuracy. - Get your tax report

Generate a comprehensive tax report ready for your accountant or local tax authority.

How to file your %blockchainName% tax report

Here’s how to file your crypto tax report with your local tax authority:

1. Review your tax report

After importing, you can generate a tax report for %blockchainName% and any other accounts you linked. This report will detail your net capital gains, losses, and income from crypto for your chosen financial year.

Review it to make sure everything looks correct. If something looks off, return to the Review tab to ensure all transactions are categorized correctly; check the Accounts tab to ensure all your accounts and their transactions have been added.

2. Download and complete the necessary tax forms

Summ can produce specific forms or summaries needed for filing. Simply check the options in the Downloads section of the tax report and choose the one you need.

For example, if you live in the US, it can produce a report ready to upload to TurboTax, as well as forms like Form 8949 and Schedule D that are pre-filled and contain the relevant information for crypto.

Summ’s reports are designed to be tax office compliant and make this straightforward.

3. File before the deadline

Make sure you file your taxes before the deadline in your country. Properly reporting your %blockchainName% crypto activity will keep you compliant and help you avoid any penalties.

If you’ve been using %exchangeName%, it’s important to understand how to report your crypto taxes. Like most exchanges, %exchangeName% does not automatically report, calculate, or issue tax forms for you. It’s up to users to report their gains, losses, and income from the platform.

The good news is that Summ makes calculating your %exchangeName% taxes quick and easy by automatically importing your data and generating comprehensive tax reports.

Disclaimer: The information in this guide is general in nature and not written for a specific tax jurisdiction or audience.

Do I need to pay taxes on %exchangeName%?

If you have been transacting on %exchangeName% during the tax year, then it’s likely you will need to pay tax based on your trading activity.

Typically, anytime you sell crypto for fiat, trade crypto-to-crypto, or earn crypto income (e.g., through staking or rewards on %exchangeName%), it is considered a taxable event in most countries.

The exact tax you owe (capital gains or income tax) will depend on your local regulations and the specifics of each transaction. Check our country-specific crypto tax guides for details on how cryptocurrency is taxed in your jurisdiction.

Do I have to pay tax if I only bought crypto on %exchangeName% but didn’t sell?

In most parts of the world, you do not pay any tax when you purchase crypto.

It is only when you later dispose of that crypto – i.e., sell it or trade it for another asset – that a taxable event occurs.

What %exchangeName% transactions are taxable?

The following are common transactions on cryptocurrency exchanges like %exchangeName% which are relevant to tax:

Most countries typically tax proceeds earned from selling investments differently from money earned as income. In crypto, you may be subject to both capital gains and income tax, depending on the nature of your transaction:

Capital Gains tax events on %exchangeName%

Whenever you sell or make a crypto-to-crypto swap on %exchangeName%, you are disposing of an asset.

If the value of the crypto at the time of sale/trade is higher than when you acquired it, you have a taxable capital gain.

If it’s lower, you have a capital loss (which can often be used to offset other gains).

Summ will automatically calculate these gains and losses for each trade using your imported transaction data. It will also account for fees according to your local tax rules.

Income tax on %exchangeName%

If you received crypto as a reward on %exchangeName% for activities such as staking, lending, or referral bonuses – those tokens are usually considered income.

The value of the crypto at the time and date you received needs to be reported as income. It also forms the cost basis if you later sell the asset.

Summ will automatically categorise income tax events and treat them according to your local tax rules.

Does %exchangeName% report to the IRS?

If you registered with %exchangeName% as a resident of the United States, then starting in the 2025 tax year, the exchange is required to report your customer data and transactions to the IRS.

Other tax authorities around the globe, like the ATO, HMRC, CRA are also engaged in data-sharing programmes with exchanges like %exchangeName%. They may also use blockchain analytics tools, data-sharing between banks and KYC and AML data to match your identity with your trading activity on %exchangeName%.

Where do I find %exchangeName% tax forms?

Exchanges like %exchangeName% do not provide tax forms with a neat breakdown of your tax obligations. This is because tax rules vary between countries and jurisdictions, which requires specialised software to handle additional complexities of crypto tax. Additionally, any assets you transfer onto the platform will be missing an accurate cost basis.

Fortunately, you can connect your exchange account to Summ via API or upload your transaction data using CSV. Summ will then combine this data with any other accounts or wallets you connect to provide you with an accurate tax report ready to submit to your tax agent, accountant or local tax authority.

You can connect as many supported exchange accounts, wallets or blockchains as you like, with reports available for all previous years on a single plan.

How to calculate %exchangeName% taxes with Summ

1. Import your data

First, you will need to import your %exchangeName% transaction data to Summ. Here are the two main methods:

Automatic API Import

This method uses a secure API feed to transfer your transaction data to Summ. Using an API ensures that your data will be updated over time, so that any change in your %exchangeName% balance is reflected in Summ.

- Sign in to Summ or create an account. Navigate to the Accounts tab and click + Add accounts.

- Select %exchangeName% from the list of exchanges. Click on Sync via API.

- Follow the instructions on the right-hand side to find your API key on %exchangeName%.

- Input your API details and click Secure Connect.

- Once authorized, Summ will automatically import your %exchangeName% transaction history. This may take a few seconds to a few minutes depending on the number of transactions. You’ll see a confirmation when all data is imported.

CSV File Upload

Not all exchanges provide easy API access; some users might prefer CSV. Sign in to Summ or create an account. Navigate to the Accounts tab and click + Add accounts.

- Select %exchangeName% from the list of exchanges. Click on Upload File.

- Follow the instructions on the right-hand side to find and download your transaction data on %exchangeName%.

- Click Import %exchangeName% CSV to upload your transaction data. Choose your file using the browser or drag and drop it into the window.

- Click Import %exchangeName% CSV to complete the upload.

- Verify the data. The software will parse the CSV and import all transactions. Double-check that the transaction details match your expectations from %exchangeName%. Summ will alert you if any data seems missing or if there are errors in the file.

Note: Some exchanges split different types of transactions into multiple files or have separate histories for sub-accounts. Make sure to import all relevant files to cover your complete trading history.

2. Generate your tax report

Once your %exchangeName% data is imported to Summ via API or CSV, you can calculate your taxes with a few clicks.

- Import accounts.

Add any other exchange accounts, wallets or transaction data to Summ. You will need to upload your entire crypto transaction history for an accurate report. - Review transactions

While Summ does the hard work for you, it may flag some missing data or errors, which you will need to review to ensure accuracy. - Get your tax report

Generate a comprehensive tax report ready for your accountant or local tax authority.

If you're new to Summ, try our Getting Started Guide for an overview of how the platform works. If you need assistance at any stage, click the chat icon in the bottom right corner to begin a live chat with our expert customer service team.

How to file your %blockchainName% tax report

Here’s what to do with your exciting and new crypto tax report:

- Review your tax report. After importing, you can generate a tax report for %exchangeName% and any other accounts you linked. This report will detail your net capital gains, losses, and income from crypto for your chosen financial year. Review it to make sure everything looks correct. If something looks off, return to the Review tab to ensure all transactions are categorized correctly; check the Accounts tab to ensure all your accounts and their transactions have been added.

- Download and complete the necessary tax forms. Summ can produce specific forms or summaries needed for filing. For example, if you live in the US, it can produce a report ready to upload to TurboTax. There are also specific forms like Form 8949 and Schedule D that contain the relevant information for crypto. Summ’s reports are designed to be tax-office compliant, making this straightforward.

- File before the deadline. Make sure you file your taxes before the deadline in your country. Properly reporting your %exchangeName% crypto activity will keep you compliant and help you avoid any penalties.

Disclaimer: This guide is for general information only and is not tax advice. Cryptocurrency tax laws vary by region. Please consult a tax professional for advice tailored to your circumstances.”

%blockchainName% is a popular crypto wallet that lets you store and manage your cryptocurrency. If you made trades, earned rewards, or interacted with DeFi using %blockchainName%, you may need to report those transactions on your taxes.

%blockchainName% does not automatically report, calculate, or issue tax forms for you.

The good news is that Summ makes calculating your %blockchainName% and crypto taxes quick and easy by automatically importing your data to generate a comprehensive tax report.

Disclaimer: The information in this guide is general in nature and not written for a specific tax jurisdiction or audience.

Do I need to file %blockchainName% taxes?

If you have been using %blockchainName% to trade crypto or use DeFi, then you will likely need to pay tax on those transactions.

The exact tax you owe will depend on whether your transactions are classified as capital gains or income. Check our list of local crypto tax guides for details on how cryptocurrency is taxed in your jurisdiction.

Do I have to pay tax if I only sent crypto to %blockchainName% but didn’t sell?

If you sent crypto to your %blockchainName% wallet and paid transaction fees in crypto (such as Ethereum Gas), then that transaction is a taxable event.

This is because you are taxed any time you dispose of your crypto.

When you pay a network fee in crypto, it is treated as though you sold (i.e., dispose) of your crypto. So even if you only paid a small fee, you will still need to pay a small amount of tax on that transaction.

Summ makes it easy to calculate the total tax owed from your %blockchainName% transactions over the tax year.

What %blockchainName% transactions are taxable?

These are how some common transactions using %blockchainName% are taxed:

Most countries typically tax proceeds earned from selling investments differently from money earned as income. In crypto, you may be subject to both capital gains and income tax, depending on the nature of your transaction.

Summ categorizes these events for you, based on your tax jurisdiction. This helps ensure that you pay the correct tax rate based on your %blockchainName% transactions, and receive any sort of discounts or allowances based on your local tax rules.

Capital Gains tax events from %blockchainName%

Whenever you dispose of crypto using %blockchainName% you are charged capital gains tax.

Disposals include things like selling crypto, swapping crypto-to-crypto, depositing crypto into DeFi, or paying network fees using crypto.

If the value of the crypto at the time of disposal is higher than when you acquired it, you have a taxable capital gain.

If it’s lower, you have a capital loss (which can often be used to offset other gains).

Summ will automatically calculate these gains and losses for each trade using your imported transaction data. It will account for fees according to your local tax rules.

Income tax events from %blockchainName%

If you received crypto as a reward for activities such as staking, lending, or yield farming – those tokens are usually considered income.

The value of the crypto at the time and date you received needs to be reported as income. It also forms the cost basis if you later sell the asset.

Summ will automatically categorise income tax events and treat them according to your local tax rules.

How to calculate your %blockchainName% taxes with Summ

1. Import your data

First, you will need to import your %blockchainName% transaction data to Summ. Here’s how:

Sync via API

- In Summ, click “Add Account” and select %blockchainName% or the relevant blockchain (e.g., Ethereum, Solana).

- Copy your wallet’s public address.

- Paste your address.

- Summ will scan the blockchain and import all your taxable events: trades, transfers, airdrops, NFT sales, staking rewards, yield farming etc.

- Do this for each address in your wallet.

Upload CSV

If you have a CSV export from a blockchain explorer or the %blockchainName% software, you can upload it manually. However, using the API sync method is usually simpler.

- In Summ, click “Add Account” and select %blockchainName% or the relevant blockchain (e.g., Ethereum, Solana).

- Click Import %blockchainName% CSV to upload your transaction data. Choose your file using the browser or drag and drop it into the window.

- Click Import %blockchainName% CSV to complete the upload.

- Verify the transaction details match your expectations from your %blockchainName% activity. Summ will alert you if any data seems missing or if there are errors in the file.

Note: If you downloaded your CSV from a block explorer, then you will need to upload a CSV for each public address you have in the wallet.

2. Generate your tax report

Once your %blockchainName% data is imported to Summ, you can calculate your taxes with a few clicks.

- Import accounts.

Add any other exchange accounts, wallets or transaction data to Summ. You will need to upload your entire crypto transaction history for an accurate report. This includes all wallets, blockchains and exchange accounts. - Review transactions

While Summ does the hard work for you, it may flag some missing data or errors, which you will need to review to ensure accuracy. - Get your tax report

Generate a comprehensive tax report ready for your accountant or local tax authority.

Need help? Click the chat icon in the bottom right corner to start a live chat with our expert customer service team. Otherwise, try our Getting Started Guide for an overview of how the platform works.

How to file your %blockchainName% tax report

1. Review your tax report

After importing, you can generate a tax report for %blockchainName% and any other accounts you linked. This report will detail your net capital gains, losses, and income from crypto for your chosen financial year.

Review it to make sure everything looks correct. If something looks off, return to the Review tab to ensure all transactions are categorized correctly; check the Accounts tab to ensure all your accounts and their transactions have been added.

2. Download and complete the necessary tax forms

Summ can produce specific forms or summaries needed for filing. Simply check the options in the Downloads section of the tax report and choose the one you need.

For example, if you live in the US, it can produce a report ready to upload to TurboTax, as well as forms like Form 8949 and Schedule D that are pre-filled and contain the relevant information for crypto.

Summ’s reports are designed to be tax office compliant and make this straightforward.

3. File before the deadline

Make sure you file your taxes before the deadline in your country. Properly reporting your %blockchainName% crypto activity will keep you compliant and help you avoid any penalties.

If you’ve been using %exchangeName%, it’s important to understand how to report your crypto taxes. Like most exchanges, %exchangeName% does not automatically report, calculate, or issue tax forms for you. It’s up to users to report their gains, losses, and income from the platform.

The good news is that Summ makes calculating your %exchangeName% taxes quick and easy by automatically importing your data and generating comprehensive tax reports.

Disclaimer: The information in this guide is general in nature and not written for a specific tax jurisdiction or audience.

Do I need to pay taxes on %exchangeName%?

Yes, you will likely need to pay tax if you used %exchangeName% during the tax year.

You will owe capital gains tax or income tax, depending on the nature of your transactions, and whether or not you receive any token rewards from %exchangeName%.

The exact tax you owe will depend on your local regulations and the specifics of each transaction. See our list of local crypto tax guides for details on how cryptocurrency is taxed in your jurisdiction.

How are %exchangeName% transactions taxed?

The taxation of DeFi platforms like %exchangeName% can vary depending on your tax jurisdiction.

Most countries typically tax proceeds earned from selling investments differently from money earned as income. You may be subject to both capital gains (CGT) and income tax, depending on the nature of your transaction.

Here’s how transactions on DeFi platforms like %exchangeName% might be treated:

%exchangeName% capital gains tax (CGT) events

%exchangeName% income tax events

%exchangeName% that are not taxed

Does %exchangeName% report to the IRS?

%exchangeName% is not required to report user activity to the IRS, however, that does not mean your transactions can’t be traced.

Blockchains are public ledgers, which makes it easy to track a wallet's activity. The IRS uses sophisticated data collection and analysis to match your real-world identity with your on-chain activity.

How to calculate %exchangeName% taxes with Summ

1. Import your data

First, you will need to import your %blockchainName% transaction data to Summ. Here’s how:

Sync via API

This method uses a secure API feed to transfer your transaction data from the %blockchainName% to Summ. Using an API ensures that your data will be updated over time.

- Sign in to Summ or create an account. Navigate to the Accounts tab and click + Add accounts.

- Select %blockchainName% from the list of integrations. Click on Sync via API.

- Enter your Ethereum wallet address. Add an optional nickname, and click 'Add Wallet'.

- Summ automatically imports your %blockchainName% transaction history from the blockchain. This may take a few seconds to a few minutes depending on the number of transactions. You’ll see a confirmation when all data is imported.

2. Generate your tax report

Once your %blockchainName% data is imported to Summ, you can calculate your taxes with a few clicks.

- Import accounts.

Add any other exchange accounts, wallets or transaction data to Summ. You will need to upload your entire crypto transaction history for an accurate report. This includes all wallets, blockchains and exchange accounts. - Review transactions

While Summ does the hard work for you, it may flag some missing data or errors, which you will need to review to ensure accuracy. - Get your tax report

Generate a comprehensive tax report ready for your accountant or local tax authority.

How to file your %blockchainName% tax report

Here’s how to file your crypto tax report with your local tax authority:

1. Review your tax report

After importing, you can generate a tax report for %blockchainName% and any other accounts you linked. This report will detail your net capital gains, losses, and income from crypto for your chosen financial year.

Review it to make sure everything looks correct. If something looks off, return to the Review tab to ensure all transactions are categorized correctly; check the Accounts tab to ensure all your accounts and their transactions have been added.

2. Download and complete the necessary tax forms

Summ can produce specific forms or summaries needed for filing. Simply check the options in the Downloads section of the tax report and choose the one you need.

For example, if you live in the US, it can produce a report ready to upload to TurboTax, as well as forms like Form 8949 and Schedule D that are pre-filled and contain the relevant information for crypto.

Summ’s reports are designed to be tax office compliant and make this straightforward.

3. File before the deadline

Make sure you file your taxes before the deadline in your country. Properly reporting your %blockchainName% crypto activity will keep you compliant and help you avoid any penalties.

If you’ve been using %exchangeName%, it’s important to understand how to report your crypto taxes. Like most exchanges, %exchangeName% does not automatically report, calculate, or issue tax forms for you. It’s up to users to report their gains, losses, and income from the platform.

The good news is that Summ makes calculating your %exchangeName% taxes quick and easy by automatically importing your data and generating comprehensive tax reports.

Disclaimer: The information in this guide is general in nature and not written for a specific tax jurisdiction or audience.

Do I need to pay taxes on %exchangeName%?

Yes, you will likely need to pay tax if you used %exchangeName% during the tax year.

You will owe capital gains tax or income tax, depending on the nature of your transactions, and whether or not you receive any token rewards from %exchangeName%.

The exact tax you owe will depend on your local regulations and the specifics of each transaction. See our list of local crypto tax guides for details on how cryptocurrency is taxed in your jurisdiction.

How are %exchangeName% transactions taxed?

The taxation of DeFi platforms like %exchangeName% can vary depending on your tax jurisdiction.

Most countries typically tax proceeds earned from selling investments differently from money earned as income. You may be subject to both capital gains (CGT) and income tax, depending on the nature of your transaction.

Here’s how transactions on DeFi platforms like %exchangeName% might be treated:

%exchangeName% capital gains tax (CGT) events

%exchangeName% income tax events

%exchangeName% that are not taxed

Does %exchangeName% report to the IRS?

%exchangeName% is not required to report user activity to the IRS, however, that does not mean your transactions can’t be traced.

Blockchains are public ledgers, which makes it easy to track a wallet's activity. The IRS uses sophisticated data collection and analysis to match your real-world identity with your on-chain activity.

How to calculate %exchangeName% taxes with Summ

1. Import your data

First, you will need to import your %blockchainName% transaction data to Summ. Here’s how:

Sync via API (Where Supported)

This method uses a secure API feed to transfer your transaction data from the %blockchainName% to Summ. Using an API ensures that your data will be updated over time.

Note: If an API connection is not available on your trading platform, you can always use a custom CSV file to import your transactions into Summ.

- Sign in to Summ or create an account. Navigate to the Accounts tab and click + Add accounts.

- Select %blockchainName% from the list of integrations. Click on Sync via API.

- Enter your Ethereum wallet address. Add an optional nickname, and click 'Add Wallet'.

- Summ automatically imports your %blockchainName% transaction history from the blockchain. This may take a few seconds to a few minutes depending on the number of transactions. You’ll see a confirmation when all data is imported.

2. Generate your tax report

Once your %blockchainName% data is imported to Summ, you can calculate your taxes with a few clicks.

- Import accounts.

Add any other exchange accounts, wallets or transaction data to Summ. You will need to upload your entire crypto transaction history for an accurate report. This includes all wallets, blockchains and exchange accounts. - Review transactions

While Summ does the hard work for you, it may flag some missing data or errors, which you will need to review to ensure accuracy. - Get your tax report

Generate a comprehensive tax report ready for your accountant or local tax authority.

How to file your %blockchainName% tax report

Here’s how to file your crypto tax report with your local tax authority:

1. Review your tax report

After importing, you can generate a tax report for %blockchainName% and any other accounts you linked. This report will detail your net capital gains, losses, and income from crypto for your chosen financial year.

Review it to make sure everything looks correct. If something looks off, return to the Review tab to ensure all transactions are categorized correctly; check the Accounts tab to ensure all your accounts and their transactions have been added.

2. Download and complete the necessary tax forms

Summ can produce specific forms or summaries needed for filing. Simply check the options in the Downloads section of the tax report and choose the one you need.

For example, if you live in the US, it can produce a report ready to upload to TurboTax, as well as forms like Form 8949 and Schedule D that are pre-filled and contain the relevant information for crypto.

Summ’s reports are designed to be tax office compliant and make this straightforward.

3. File before the deadline

Make sure you file your taxes before the deadline in your country. Properly reporting your %blockchainName% crypto activity will keep you compliant and help you avoid any penalties.

If you've been trading crypto on %exchangeName%, understanding how to properly report your taxes is more critical than ever. With the introduction of IRS Form 1099-DA, exchanges like %exchangeName% are now required to report your crypto transactions, profits, loss and income directly to the IRS. However, this information from exchanges may be incorrect or incomplete, and it's up to you to report the accurate figures to the IRS.

The good news is that Crypto Tax Calculator makes calculating your %exchangeName% taxes quick and easy by automatically importing your data and generating comprehensive tax reports.

Disclaimer: The information in this guide is for US taxpayers and is general in nature. Cryptocurrency tax laws are complex and subject to change. Consult a tax professional for advice tailored to your circumstances.

What is Form 1099-DA and how does it affect %exchangeName% users?

Starting in 2026, %exchangeName% will issue Form 1099-DA (Digital Asset Proceeds From Broker Transactions) to report your crypto transactions from the 2025 tax year directly to the IRS. This marks a significant shift in crypto tax reporting.

What will be on your 1099-DA?

For the 2025 tax year (forms issued in early 2026), your 1099-DA will show:

- Gross proceeds from sales and disposals of digital assets on %exchangeName%

- Transaction dates and details

Starting with the 2026 tax year and beyond, your 1099-DA will also include:

- Cost basis information (but only for assets bought and sold on %exchangeName%)

- Adjusted basis and wash sale information

Why your 1099-DA might lead you to overpay on your tax

Here's the challenge: %exchangeName% can only report cost basis for crypto that you bought and sold entirely on their platform.

If you transferred crypto into %exchangeName% from another wallet or exchange, %exchangeName% has no record of your original purchase price (cost basis). In these cases, the 1099-DA may show a blank cost basis or $0 – making it look like your entire proceeds are taxable gains, even when they're not. You could wind up paying thousands of dollars of tax even if you made a loss.

Additionally, the 1099-DA won't capture:

- Transactions on exchanges or wallets that do not report to the IRS

- DeFi activity

- Wallet-to-wallet transfers

This is where Crypto Tax Calculator becomes essential. Our platform aggregates your complete transaction history across all exchanges, wallets, and DeFi protocols to calculate your true cost basis and ensure your tax report matches the IRS's records while accurately reflecting your actual tax liability.

Do I need to pay taxes on %exchangeName%?

Yes. If you've been transacting on %exchangeName% during the tax year, you're required to report your crypto activity to the IRS.

In the United States, anytime you sell crypto for cash, trade one crypto for another, or earn crypto income (such as staking rewards or referral bonuses on %exchangeName%), it's considered a taxable event.

The type of tax you owe depends on the transaction:

- Capital gains tax applies when you sell or trade crypto

- Income tax applies when you receive crypto as payment or rewards

The IRS treats cryptocurrency as property, which means the same tax rules that apply to stocks and other investments also apply to your crypto transactions on %exchangeName%.

Do I have to pay tax if I only bought crypto on %exchangeName% but didn't sell?

No. Simply buying and holding crypto is not a taxable event in the United States.

You only owe taxes when you later sell, trade, or otherwise dispose of that crypto. However, you should keep careful records of your purchase price and date, as this information will be needed to calculate your cost basis when you eventually sell.

What %exchangeName% transactions are taxable?

The following are common transactions on cryptocurrency exchanges like %exchangeName% which are relevant to tax:

In the US, proceeds from selling investments are taxed differently than income you earn. With crypto, you may be subject to both capital gains and income tax, depending on the transaction type:

Capital Gains tax events on %exchangeName%

Whenever you sell, swap or trade crypto on %exchangeName%, you're disposing of an asset for tax purposes.

If the value at the time of sale is higher than when you acquired it, you have a taxable capital gain. If it's lower, you have a capital loss, which can be used to offset other gains and reduce your tax bill.

Capital gains from crypto are reported on IRS Form 8949 and Schedule D. The proceeds on your Form 8949 must match what's reported on your 1099-DA from %exchangeName%–which is why accurate record-keeping across all your crypto accounts is essential.

Crypto Tax Calculator automatically calculates your gains and losses for each trade, properly accounts for transaction fees, and generates Form 8949 reports that reconcile with your 1099-DA forms.

Income tax on %exchangeName%

If you received crypto on %exchangeName% through staking rewards, lending interest, referral bonuses, or other earning activities, the IRS treats this as ordinary income.

You must report the fair market value of the crypto on the date you received it as income on your tax return. This value also becomes your cost basis if you later sell those tokens.

Crypto Tax Calculator automatically identifies and categorizes income events, calculates the USD value at the time of receipt, and ensures everything is reported correctly for IRS compliance.

Does %exchangeName% report to the IRS?

Yes. Starting with the 2025 tax year, %exchangeName% is required by law to report your digital asset transactions to the IRS using Form 1099-DA.

This means the IRS will have a record of your gross proceeds (and eventually cost basis) from crypto transactions on %exchangeName%. You'll receive a copy of your 1099-DA in early 2026 for your 2025 transactions.

The IRS can also use blockchain analytics, bank data sharing, and Know Your Customer (KYC) information to connect your identity to your crypto activity–even across multiple platforms. The bottom line: your crypto transactions are not anonymous to the IRS.

Where do I find %exchangeName% tax forms?

Starting in 2026, %exchangeName% will send you Form 1099-DA showing your gross proceeds from digital asset sales during the 2025 tax year. However, this form alone won't give you everything you need to accurately file your taxes.

Why the 1099-DA isn't enough

Your 1099-DA from %exchangeName% only shows activity on that single platform. It won't include:

- Transactions on other exchanges or wallets you use

- DeFi activity

- Accurate cost basis for crypto you transferred into %exchangeName%

- Complete context for your overall crypto tax situation

Without aggregating data from all your crypto accounts, you risk either overpaying taxes or filing an inaccurate return that doesn't match your 1099-DA–potentially triggering an IRS audit.

How Crypto Tax Calculator helps

Connect your %exchangeName% account to Crypto Tax Calculator via API or CSV upload. We'll automatically combine this data with all your other exchanges, wallets, and DeFi protocols to:

- Calculate accurate cost basis across all your accounts

- Generate IRS-compliant tax reports including Form 8949

- Ensure your tax return properly reconciles with your 1099-DA forms

- Identify every taxable event, including those not on your 1099-DA

You can connect unlimited accounts and generate reports for any previous tax year on a single plan.

How to calculate %exchangeName% taxes with Crypto Tax Calculator

1. Import your data

First, you will need to import your %exchangeName% transaction data to Crypto Tax Calculator. Here are the two main methods:

Automatic API Import

This method uses a secure API feed to transfer your transaction data to Crypto Tax Calculator. Using an API ensures that your data will be updated over time, so that any change in your %exchangeName% balance is reflected in Crypto Tax Calculator.

- Sign in to Crypto Tax Calculator or create an account. Navigate to the Accounts tab and click + Add accounts.

- Select %exchangeName% from the list of exchanges. Click on Sync via API.

- Follow the instructions on the right-hand side to find your API key on %exchangeName%.

- Input your API details and click Secure Connect.

- Once authorized, Crypto Tax Calculator will automatically import your %exchangeName% transaction history. This may take a few seconds to a few minutes depending on the number of transactions. You’ll see a confirmation when all data is imported.

CSV File Upload

Not all exchanges provide easy API access; some users might prefer CSV. Sign in to Crypto Tax Calculator or create an account. Navigate to the Accounts tab and click + Add accounts.

- Select %exchangeName% from the list of exchanges. Click on Upload File.

- Follow the instructions on the right-hand side to find and download your transaction data on %exchangeName%.

- Click Import %exchangeName% CSV to upload your transaction data. Choose your file using the browser or drag and drop it into the window.

- Click Import %exchangeName% CSV to complete the upload.

- Verify the data. The software will parse the CSV and import all transactions. Double-check that the transaction details match your expectations from %exchangeName%. Crypto Tax Calculator will alert you if any data seems missing or if there are errors in the file.

Note: Some exchanges split different types of transactions into multiple files or have separate histories for sub-accounts. Make sure to import all relevant files to cover your complete trading history.

2. Generate your tax report

Once your %exchangeName% data is imported to Crypto Tax Calculator via API or CSV, you can calculate your taxes with a few clicks.

Add any other exchange accounts, wallets or transaction data to Crypto Tax Calculator. You will need to upload your entire crypto transaction history for an accurate report.

While Crypto Tax Calculator does the hard work for you, it may flag some missing data or errors, which you will need to review to ensure accuracy.

Generate a comprehensive tax report ready for the IRS or your accountant.

If you're new to Crypto Tax Calculator, try our Getting Started Guide for an overview of how the platform works. If you need assistance at any stage, click the chat icon in the bottom right corner to begin a live chat with our expert customer service team.

How to file your %exchangeName% tax report

Here's what to do with your crypto tax report from Crypto Tax Calculator:

- Review your tax report. After importing all your accounts, generate a comprehensive tax report. This will detail your net capital gains, losses, and income from crypto for the tax year. Review it carefully to ensure all transactions are categorized correctly and all accounts have been added. Your report will show how your transactions reconcile with the 1099-DA forms you'll receive from %exchangeName%.

- Download your IRS forms. Crypto Tax Calculator generates the specific forms you need for filing, including:

- Form 8949 (Sales and Other Dispositions of Capital Assets)

- Schedule D (Capital Gains and Losses)

- Reports formatted for TurboTax, TaxAct, and other tax software

- Complete transaction histories for audit support

- File before the IRS deadline. The standard deadline for individual US tax returns is April 15th. Make sure you file on time and accurately report all your crypto activity from %exchangeName% and other platforms to avoid penalties and interest charges.

Ready to make tax filing simple?

If you haven’t already, sign up for Crypto Tax Calculator to get your %exchangeName% tax report in minutes.

With a single account, you have all your transaction data in one place, and the heavy lifting will be done for you for years to come.

Make sure to review your report and then confidently file your taxes knowing you've accurately reconciled your 1099-DA forms with your complete crypto activity. Keeping accurate records and properly reporting your crypto gains and income is crucial for IRS compliance.

If you have any issues or questions, our support team is here to help (reach out via chat or email). Crypto taxes are much easier when you have the right tools – and we're happy to provide that for you.

Ready to get started? Generate your %year% crypto tax report for %exchangeName% now and confidently prepare for tax season!

Disclaimer: The information in this guide is for US taxpayers and is general in nature. Cryptocurrency tax laws are complex and subject to change. Consult a tax professional for advice tailored to your circumstances.

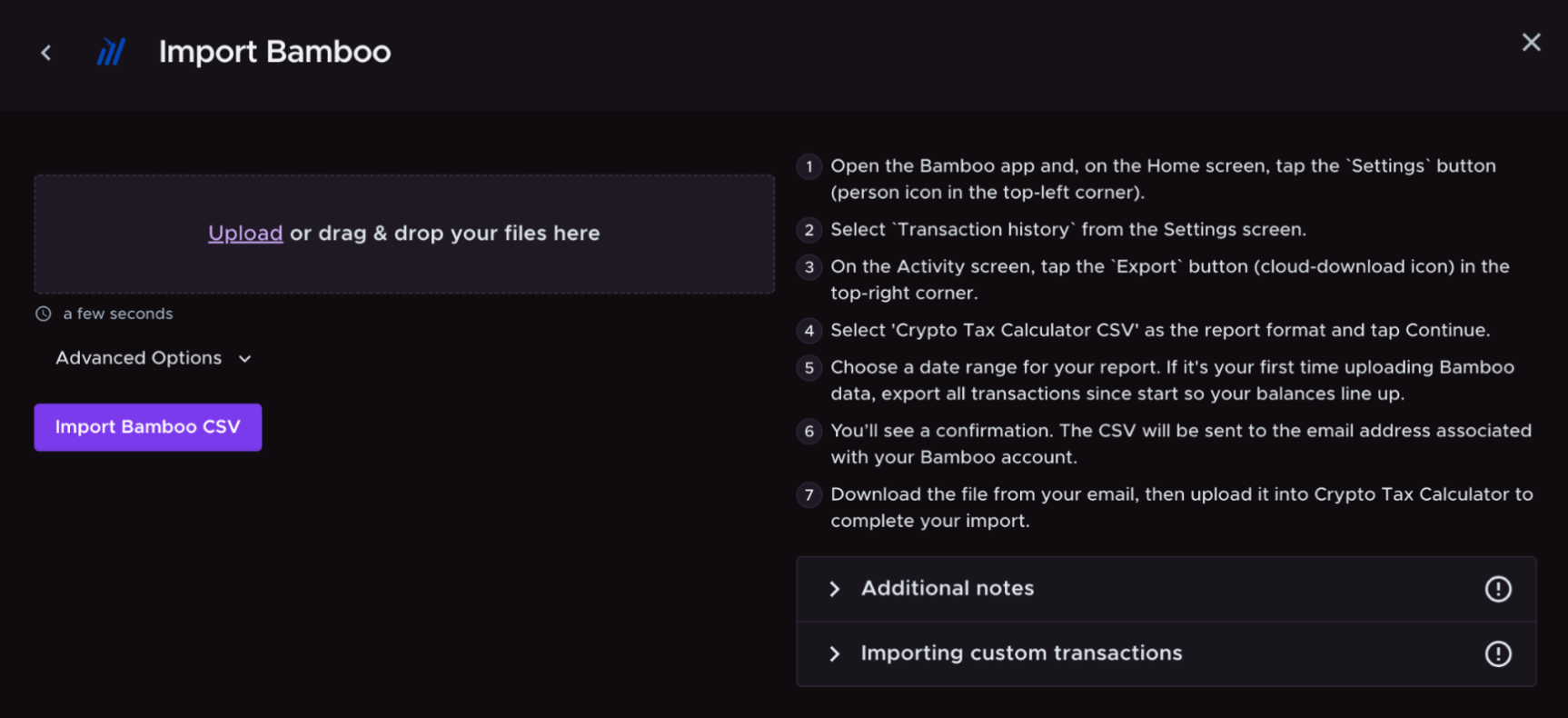

How to import your Bamboo data into Crypto Tax Calculator

Crypto Tax Calculator allows you to upload Bamboo transactions by CSV upload. Uploading your transactions allows Crypto Tax Calculator to calculate your Bamboo tax obligation.

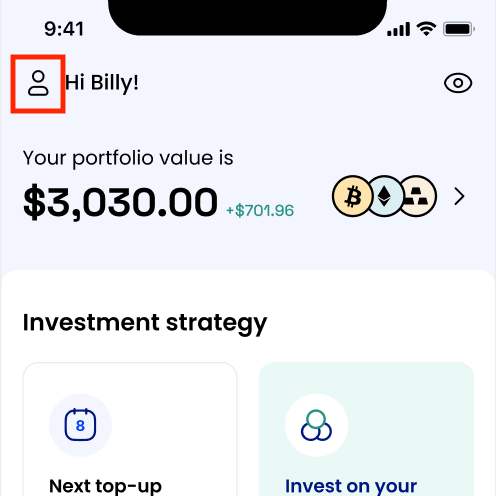

- Open the Bamboo app and, on the Home screen, tap the Settings button (person icon in the top-left corner).

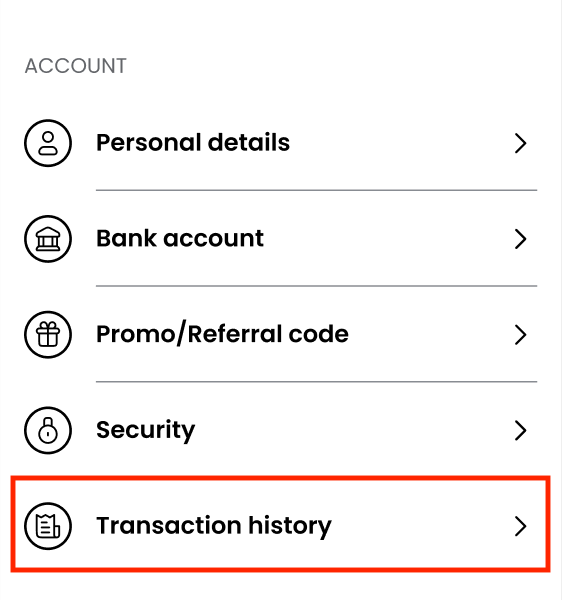

2. Select Transaction history from the Settings screen.

3.On the Activity screen, tap the Export button (cloud-download icon) in the top-right corner.

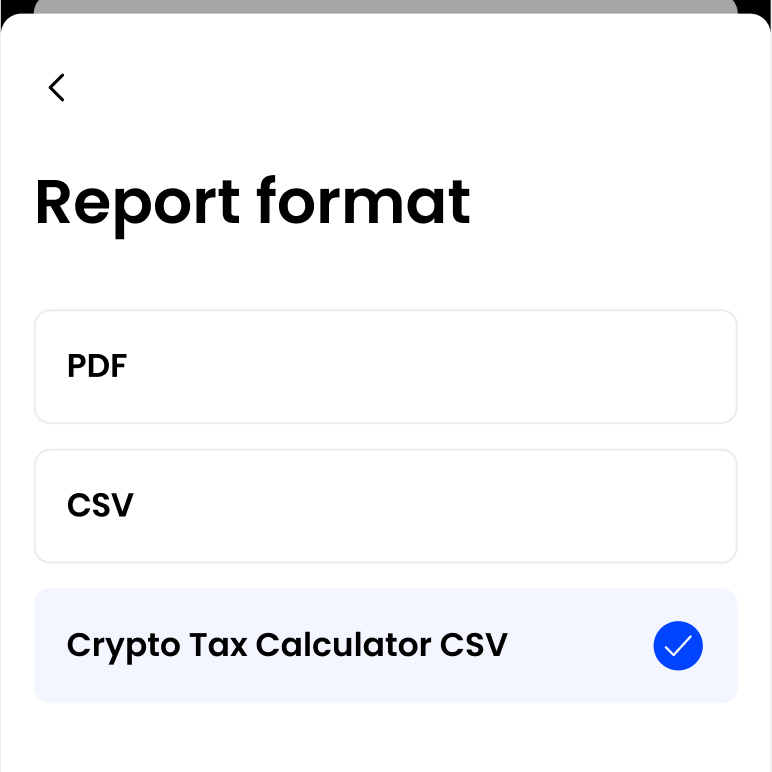

- Select Crypto Tax Calculator CSV as the report format and tap Continue.

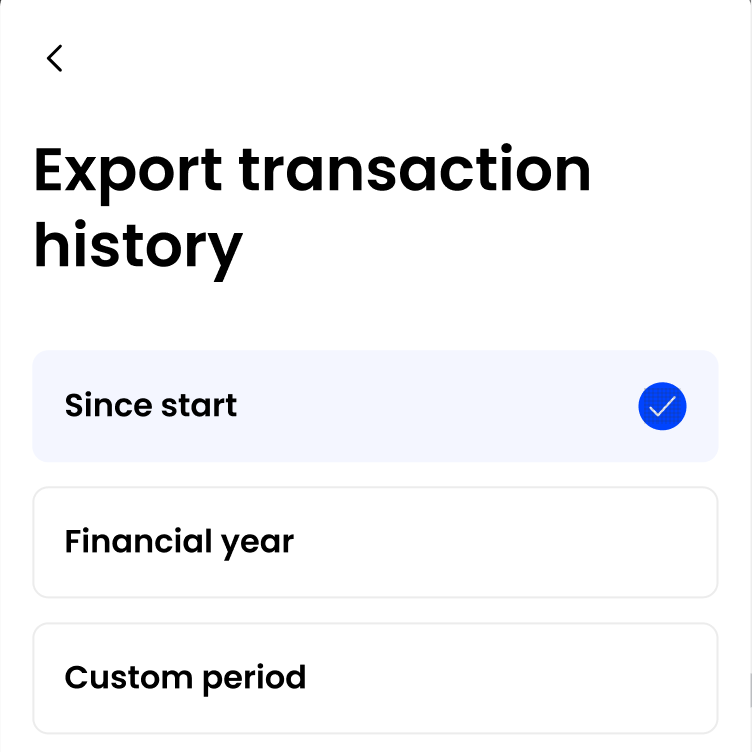

- Choose a date range for your report:

- Since start - downloads all data since you’ve started using the app.

Note: First time using CTC? Export all transactions from the start so your balances line up. - Financial year - choose the financial year you want to download the transactions for.

- Custom period - set your own start and end dates of the report.

- A confirmation message appears - your CSV is emailed to the address linked to your Bamboo account.

Tip: If the email doesn’t arrive within a few minutes, check your spam folder or confirm your email address in Settings → Personal details. For additional help, go to Profile → Help & Support in the Bamboo app.

- Download the file from your email, then upload it into Crypto Tax Calculator.

Wrapping Up

Once you have uploaded all your crypto data Crypto Tax Calculator can calculate your portfolio breakdown and crypto tax obligation.

The information provided on this website is general in nature and is not tax, accounting or legal advice. It has been prepared without taking into account your objectives, financial situation or needs. Before acting on this information, you should consider the appropriateness of the information having regard to your own objectives, financial situation and needs and seek professional advice. Summ (formerly Crypto Tax Calculator) disclaims all and any guarantees, undertakings and warranties, expressed or implied, and is not liable for any loss or damage whatsoever (including human or computer error, negligent or otherwise, or incidental or Consequential Loss or damage) arising out of, or in connection with, any use or reliance on the information or advice in this website. The user must accept sole responsibility associated with the use of the material on this site, irrespective of the purpose for which such use or results are applied. The information in this website is no substitute for specialist advice.