Hello there, crypto tax pals! We’ve decided to turn out product newsletters into blog posts, so you can access information on the latest updates from various sources. Without further ado, let’s dive into the latest Product Update.

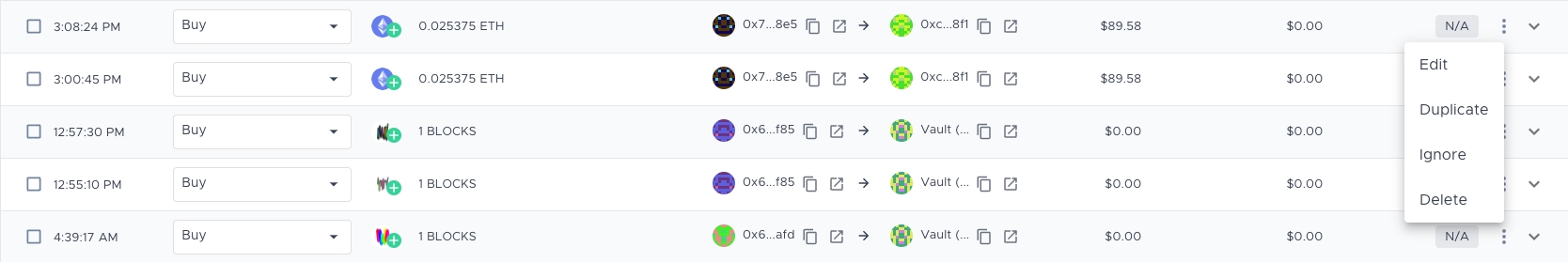

Duplicate transaction

You are now able to duplicate transactions in the review transactions page. For the transaction in question, simply click on the three dots, and select "Duplicate". This will duplicate the contents of the original transaction, for both individual, and grouped transactions (e.g. Trade and Swap).

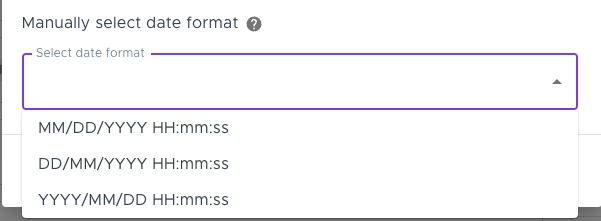

Ability to select date format for Manual CSV imports

Whilst we previously only supported importing manual CSVs in our standard date format (YYYY-MM-DD), we now support importing CSVs with two new date formats: MM-DD-YYYY and DD-MM-YYYY. You can select these within the Advanced dropdown.

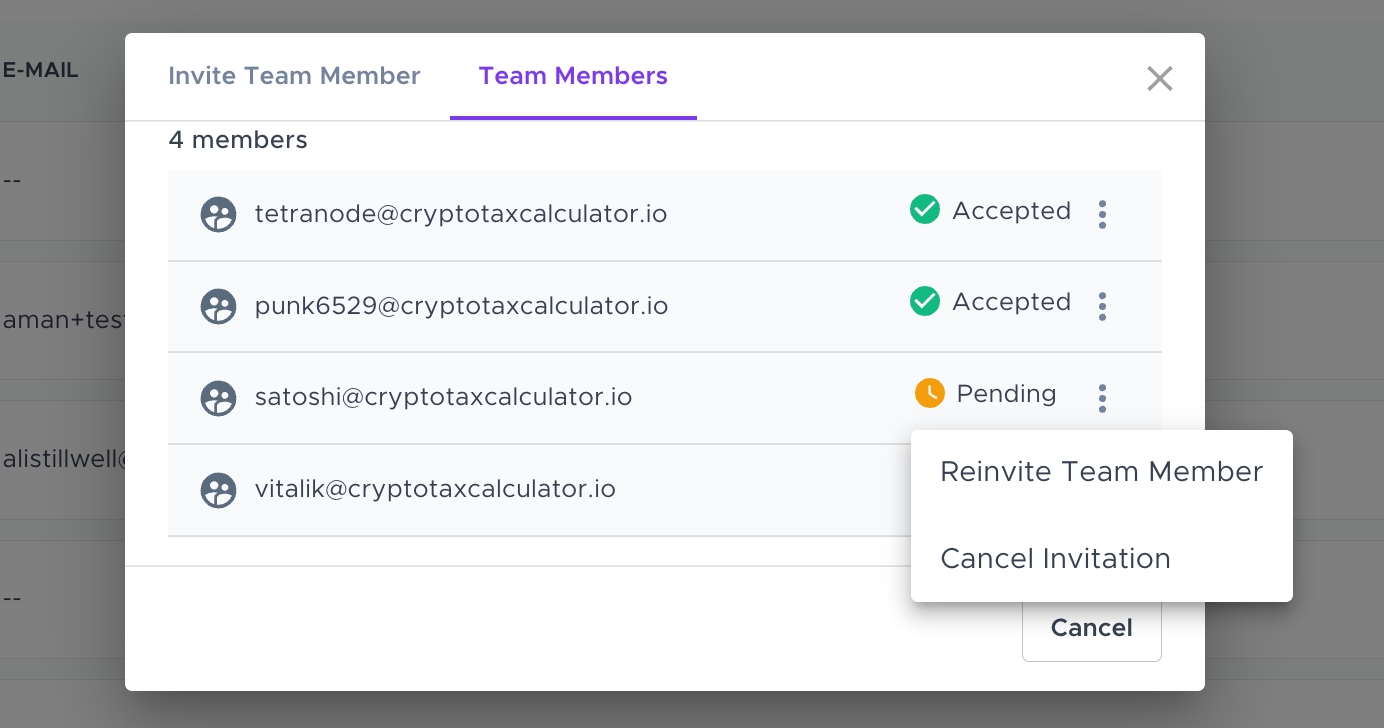

Upgraded accountant functionality

Users on our accountant plan now have the ability to re-invite collaborators and cancel pending invitations.

New report: Expense report

This is a new report outlining any miscellaneous expenses that you may have incurred when making crypto transactions. It includes any expense transactions, fee transactions, and gas fees or exchange fees when making a transfer between wallets or exchanges.

New landing pages

On our new accountant landing page, you can now book a demo with us, or submit an accountant enquiry form to get directly in touch with our partnerships team.

We also have 3 new feature pages to highlight 3 core aspects of our app: NFT Support, DeFi Support and Tax Reports.

New integration

We’re excited to announce that our integration with eToro is now live!

Simply download your eToro transaction history CSV, and import it into our app to start reconciling your eToro transactions.

Minor changes

We have added support for the updated Kucoin CSV and Coinex CSV files.

The Import Data page has had a UI uplift, to make it as easy as possible to add in new wallets and exchanges into Summ (formerly Crypto Tax Calculator).

The bulk edit bar has also had a slight re-design to make it easier to implement new changes.

You can now filter by wallet nickname in the review transactions page.

Die auf dieser Website bereitgestellten Informationen sind allgemeiner Natur und stellen keine Steuer-, Buchhaltungs- oder Rechtsberatung dar. Es wurde ohne Rücksicht auf Ihre Ziele, Ihre finanzielle Situation oder Ihre Bedürfnisse erstellt. Bevor Sie aufgrund dieser Informationen handeln, sollten Sie die Angemessenheit der Informationen im Hinblick auf Ihre eigenen Ziele, Ihre finanzielle Situation und Ihre Bedürfnisse prüfen und professionellen Rat einholen. Summ (ehemals Crypto Tax Calculator) lehnt jegliche ausdrückliche oder stillschweigende Garantien, Zusicherungen und Gewährleistungen ab und haftet nicht für Verluste oder Schäden jeglicher Art (einschließlich menschlicher Fehler oder Computerfehler, fahrlässiger oder sonstiger Art oder zufälliger Verluste oder Folgeschäden), die sich aus oder in ergeben Verbindung mit, jegliche Nutzung oder Vertrauen auf die Informationen oder Ratschläge auf dieser Website. Der Benutzer muss die alleinige Verantwortung für die Verwendung des Materials auf dieser Website übernehmen, unabhängig vom Zweck, für den diese Verwendung oder Ergebnisse verwendet werden. Die Informationen auf dieser Website sind kein Ersatz für eine fachkundige Beratung.